Online Invoice Generator by Neet

The Neet Invoice Generator has been designed to help small businesses and independent contractors easily create and send invoices that meet the requirement of the Australian Taxation Office (ATO) and look professional.

What information does an invoice require?

The ATO require certain information to be included in tax invoices. For sales made under $1,000 the tax invoice must meet the following 7 requirements:

- The document must be intended to be a tax invoice;

- It must identify the seller;

- The seller’s ABN must be included;

- The invoice must be dated;

- There must be a description around what was being sold;

- If applicable, the amount of GST must be identified; and

- It must state weather or not each sale on the invoice is a taxable supply.

If the sale is for $1,000 or more, the invoice must also include the buyer’s identity or ABN (if they have one).

Recording GST on Tax Invoices

Tax invoices for GST registered businesses must clearly show whether each item attracts GST or if it is GST Free. In some circumstances, invoices will contain various items that are taxed differently, which is why it’s not enough to simply ‘add 10%’ to the total figure. The Neet invoice generator allows for multiple line items with different tax treatment to meet this requirement.

Including your payment terms on invoices

Payment terms are determined by the supplier, and will generally be displayed as a due date on the tax invoice. In reality, buyers will have their payment terms. Before undertaking a transaction, both businesses should agree on the payment terms, but in reality this rarely happens for small businesses.

There is nothing wrong with putting your due date as the same date that the invoice is generated. As a supplier, you will rarely get paid before the due date, so bringing it forward can help keep cashflow coming.

The Business Council of Australia has developed an Australian supplier payment code, which is a voluntary code designed to stop big business taking advantage of small businesses. Signatories to that code have agreed to pay small business suppliers on time and within 30 days.

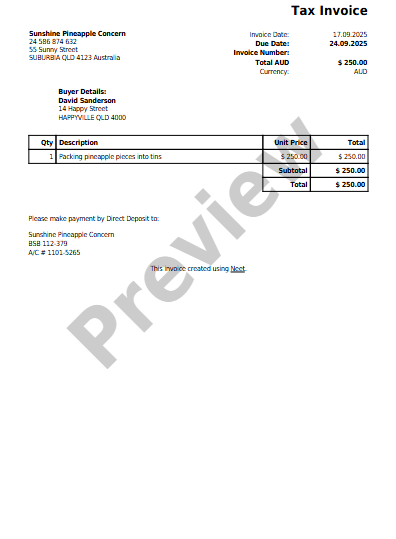

The Neet Invoice Template

Neet Invoice Generator has five different invoice templates, which all meet the ATO requirements for invoices. There is a wizard to help you generate compliant invoices and email them to your customer. The free invoice template is shown below.